THE POINTCO LIVING BUSINESS LINE

POINTCO CAPITAL,

AN EXPERIENCED CONSULTANCY DEDICATED TO YOUR PROPERTY TRANSACTIONS

AN EXPERIENCED CONSULTANCY DEDICATED TO YOUR PROPERTY TRANSACTIONS

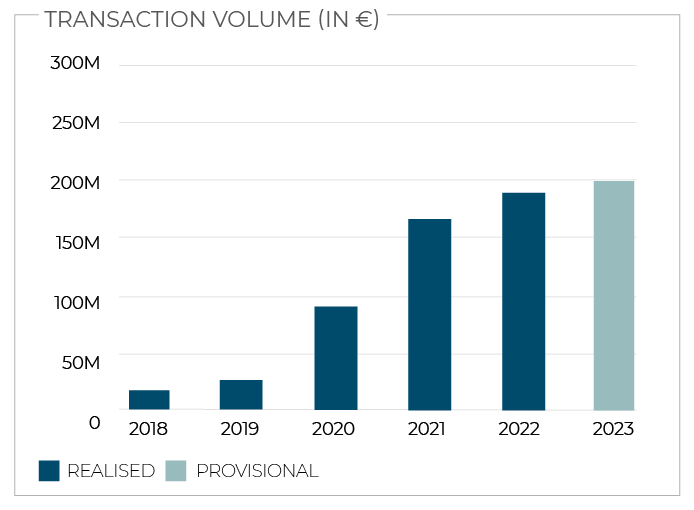

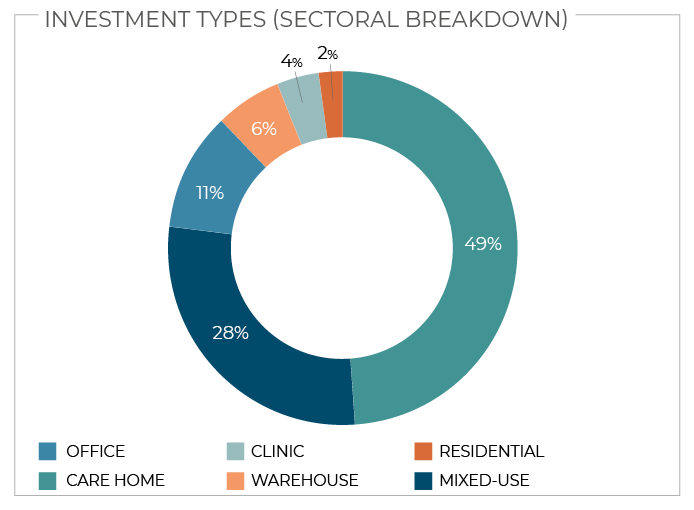

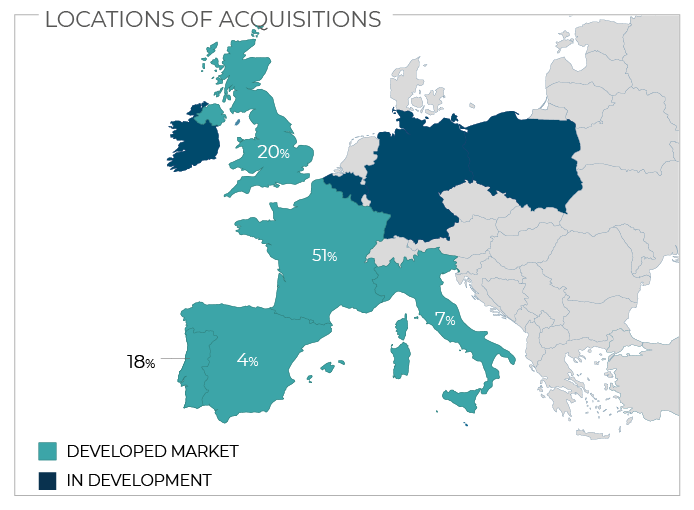

With over €604 million in transactions completed since 2013, PointCo Capital is a pan-European real estate advisory firm with expertise across all commercial asset classes. Our international track record includes deals signed in France, Portugal, Spain, Italy, the UK, Ireland and Canada, with projects in pipeline in other countries, notably in Central and Eastern Europe.

OVER 12 YEARS' EXPERIENCE IN REAL ESTATE

2024

CREATION OF

2023

OPENING UP

THE IRISH MARKET

2022

EXPANSION INTO VARIOUS

ASSET CLASSES

ASSET CLASSES

2021

OPENING UP

THE CANADIAN MARKET

THE CANADIAN MARKET

+604 M€

In transaction volume

since 2013

6

Asset

classes

83

TRANSACTION REALISED

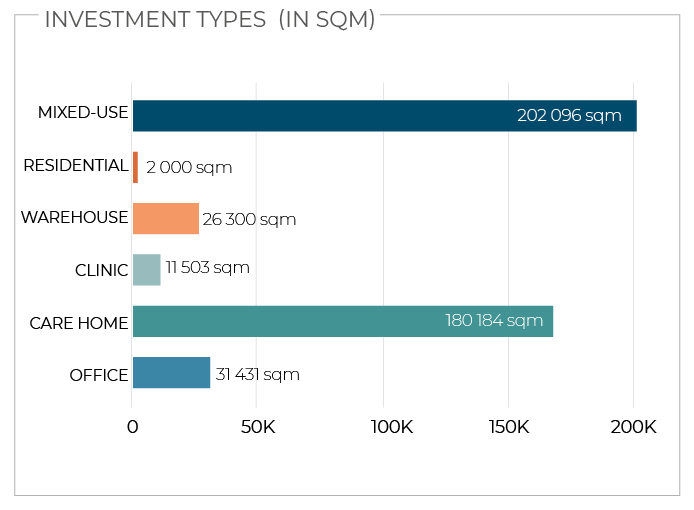

+445 K

OF SQM, ALL ASSETS CLASSES COMBINED

1

2

3

4

OUR EXPERTISE AT THE SERVICE OF YOUR PROPERTY STRATEGY

A COMMITMENT ALONGSIDE ALL STAKEHOLDERS

At PointCo, our main ambition is to combine the construction of a responsible future with the growth of our clients and partners by offering our expertise for their development.

OUR EXPERTISE AT THE SERVICE OF ALL STAKEHOLDERS.

SUPPORTING OUR CLIENTS AND PARTNERS IN THEIR LOCAL AND INTERNATIONAL DEVELOPMENT.

CONTRIBUTING TO A BETTER QUALITY OF LIFE.

OUR ESG COMMITMENTS

From the operator's governance […] to social criteria, it is important to address all aspects of a real estate investment's social responsibility.

OUR INTERNATIONAL TRACK RECORDS

Please select a country to see its track records

UK

- 17BUILDINGS

- 61.749SQM

- 1.265BEDS

Ireland

- 1BUILDINGS

- 5800SQM

- 99BEDS

France

- 43BUILDINGS

- 263.298SQM

Portugal

- 16BUILDINGS

- 72.311SQM

- 1.350BEDS

Italy

- 4BUILDINGS

- 33.4SQM

- 780BEDS

Spain

- 3BUILDINGS

- 14.326SQM

- 321BEDS

Canada

- 1BUILDINGS

- 202BEDS

- 8.815SQM

|

POINTCOTEAM

- All

- Finance

- Management

- Support

- All

- Germany

- France

- UK

- Portugal

- Spain

- Italy

- Poland

- Canada

- Other